The entire premise of the AI boom makes no sense. But it was never meant to.

Will LockettFollow

The AI boom is idiotic, needlessly complex, and wrapped up in a huge amount of convoluted propaganda that makes it nearly impossible to unpick it all and figure out what the hell is actually going on. What we need is a helicopter view. Something that helps us cut through the crap and get a lay of the land. Only then can we chart a way forward that doesn’t end in disaster. There is one simple graph that does this better than anything I have ever seen. However, it is truly terrifying, and not for reasons you might think, because AI has very little to do with AI.

The logic surrounding the AI boom is utterly moronic. The idea is to gamble the entire Western economy by heavily investing in technology that will wipe out almost all jobs. It is a lose-lose scenario. If the bet fails, the economy crashes. If the bet succeeds, the economy crashes. And this graph shows that this is precisely what is happening.

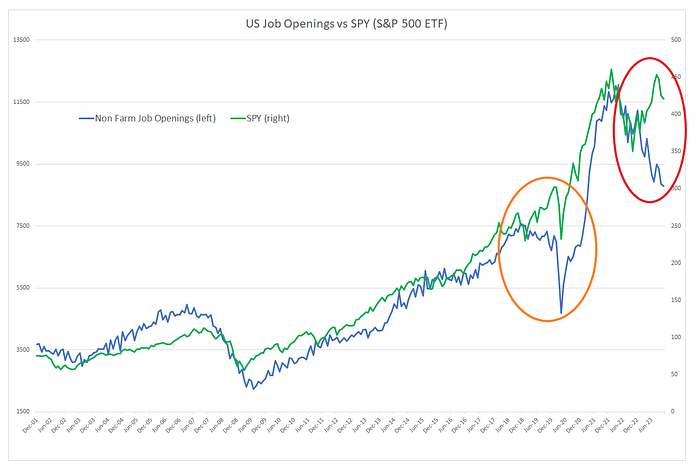

Above is a graph of the value of the S&P 500 (in green), an index fund of the largest 500 companies in the US, and the total number of job openings in the US (in blue). As you can see, historically, the two have had a very strong correlation. If you think about it, that makes perfect sense. When the economy does well, companies expand and hire more people, which increases their value. Even during times of significant economic change, such as 2007–2008 and 2020, the two increased and decreased at more or less the same rate.

From November 30th, 2022, this correlation dramatically reversed. Since then, the S&P 500 has increased a staggering 70%, yet job openings have plummeted by 30%. As the economy grows, more jobs are created — that is an utterly fundamental part of not just our economy, but how our society functions. Something monumental must have happened here to decouple growth from labour, something on par with the Industrial Revolution.

Well, guess what came out on November 30th, 2022? ChatGPT.

AI is filling the jobs and powering growth. The economy doesn’t need us anymore. This insane lose-lose scenario is playing out before our eyes.

Or is it? Because, actually, AI is not replacing jobs at all.

I know I keep referring to these studies, but they are so damn important. A recent MIT report found that 95% of AI pilots didn’t increase a company’s profit or productivity. A recent METR report also found that AI coding tools actually slow developers down. Why? Well, generative AI models, even the very latest ones, often get things wrong and “hallucinate”, which requires considerable human oversight to correct. IT consultants Gartner attempted to quantify this and found that AI agents fail to complete office tasks around 70% of the time. A recent Harvard Business Review survey has found that 40% of workers have had to deal with “workslop” in the past month, which they define as “AI-generated work content that masquerades as good work but lacks the substance to meaningfully advance a given task.” Each workslop incident wastes nearly two hours on average, meaning that for every 10,000 workers, workslop costs $9 million per year in wasted time, easily wiping out any productivity gains from deploying AI and reducing overall productivity.

So, the data actually shows that AI can’t even successfully augment most jobs and make workers more productive, let alone replace jobs. In other words, it hasn’t decoupled growth from labour. Economic output is still dependent on labour. So, what on Earth is going on with that graph?

Well, something seismic has happened to the economy, but it wasn’t caused by AI. Instead, AI is just the symptom.

Derek Thompson, a fellow Substack writer, wrote a fantastic piece debunking the cause of this separation.

Firstly, he points out that job openings did not peak in November 2022 but much earlier in March. In other words, this monumental change happened before the mass roll-out of AI. Instead, the event which actually caused this plummet was the Federal Reserve raising interest rates. In an attempt to recover the economy after the pandemic, interest rates were cut, and money was printed. This made the economy hot, and it recovered quickly, but inflation rose to incredibly high levels, posing a significant risk of overheating and a crash. So, they raised interest rates to cool the economy, but this also reduced investment, which in turn reduced economic activity and hiring, which is why job openings fell.

But the S&P 500 was also meant to fall. After all, that was the motivation for this rate hike: to rein in an economy that was growing too quickly for its own good. Why didn’t this happen? Speculation.

Since November 2022, over 75% of the S&P 500’s growth has come from a small handful of AI companies. This is the main force separating the S&P 500 from the declining job openings. It isn’t that jobs are being replaced, but that AI is valued so highly.

But why?

AI is lightyears away from profitability (read more here) and can’t be used to effectively improve productivity (read more here), and we have known it has been butting up against a serious diminishing returns issue, meaning it physically can’t get much better than it is today, for years now (read more here). As a business, as an investment, AI makes no sense at all. It should not be valued remotely highly.

But, there was perceived potential there. Thanks to years of propaganda and reframing, the world came to see AI as this incredible futuristic technology that would revolutionise everything. Yet, the vast majority of people didn’t understand how it worked, its limitations, or its drawbacks. Due to the work published by Google in 2017, AI was just beginning to resemble this potential by 2022.

These Big Tech companies and their major investors had a choice. Follow the monetary policy, and take a minor hit in value while the economy sorted itself out. Or, ignore it, and use this perfect opportunity to embrace wildly unrealistic speculation and keep their value tracking upwards. They chose the latter and, through intra-industry and circular investing, managed to isolate this money machine from the wider economy. . Then, propaganda pushed by the investment banker “analysts” who poured money into this cycle grew it even more, making their own moronic investment “worth” more and giving this trainwreck the appearance of credibility.

This is why the S&P 500 didn’t decrease alongside job openings. Big Tech was large enough and powerful enough to reject monetary policy, so they built their own separate ouroboros-esque economy based on their own deranged desire to grow at all costs, rather than the needs of their consumers or reality. .

This has pushed the US into a functional recession, even if the S&P 500 didn’t reflect it. Deutsche Bank found that if you exclude AI expenditure from the US’s GDP, its growth has actually dropped off rapidly to near zero, which is a key warning sign of a recession. The cost of living is soaring, real-term wages have fallen, and unemployment has risen. This threatened to crush the actual economy, so the Federal Reserve began cutting interest rates in late 2024 to boost investment and create jobs and has continued to cut them since.

So, why haven’t we seen job openings grow since then?

Suddenly, investment banks, venture capitalists and large corporations can borrow huge amounts of money for far less. They should invest in corporate expansion and create new jobs, right? But they had just experienced multiple years of the only significant growth coming from this separate economy of intra-industry speculative AI investing. So, Big Tech, their investors, and their investment-banking backers used this new, cheaper debt to pour more money into this false self-valuing money machine, because that was where they saw the most significant return.

If you have ever wondered why CEOs, analysts, hedge fund managers and the corporate elite have such a twisted and ignorant view about AI, this is why. To them, it is a miracle. When the economy should be going down, and their assets falling in value, they can stave it all off by dumping money into this false money machine. They don’t care if it hurts the actual business or if the entire premise of AI is utterly false. It makes them filthy rich when they should be losing money, so they are more than happy to queue up for it.

Until this rate cut, this separate AI boom economy had funded itself through equity. The AI companies would sell off smaller and smaller chunks of themselves to Big Tech and these institutional investors for more and more money, artificially boosting their value and making previous investments worth more. When this pool was drained, they switched to more efficient but much more dodgy circular equity financing. Basically, these tech giants and investment firms were passing the same money around in a circle, buying smaller and smaller chunks of each other, which again artificially boosted each company’s value.

However, when the Federal Reserve cut interest rates, a new stream of money became available. These AI companies are increasingly funding themselves with significant amounts of “cheap” debt. This increases how much they spend on AI, which doesn’t create more jobs but does increase speculative value, as it is thought that whoever spends the most will have the best AI, even though DeepSeek proved that notion wrong a long time ago. Enabled by this rate cut, the AI industry has rapidly taken on more than $1.2 trillion worth of debt.

So, again, the monetary policy was rejected. Rather than being used to fuel actual expansion, increase the number of jobs and stabilise the real economy, the rate cut was used to support and grow this separate, false AI economy.

Okay, so let’s bring this all together.

This is why that graph is so damn terrifying. It isn’t because it shows how AI is affecting the economy. Instead, it shows that AI is just a symptom of Big Tech and the financial elite hijacking the economy for their own gain.

It has been no secret that Big Tech hates capitalism. Peter Thiel, who backed the AI giants Meta and OpenAI and founded Palantir, even delivered a public lecture titled “Competition is for Losers” in which he literally tells people to build monopolies. Silicon Valley is full of these authoritarian technocratic anarcho-capitalist types, who hate the free market, democracy and the accountability these systems entail. Instead, they want to own and control the government and the policies that dictate their actions and the economy so that they can manipulate the system to pour wealth into their own laps. Hell, Thiel founded PayPal in the ’90s explicitly as an anarcho-internet bank that was isolated from government control, heavily implying that it would be better if only he controlled it.

For decades, Big Tech has wanted to not just dominate the market but break free of democratic control, whether that be governmental or economic, to fuel infinite value growth without the hassle of actually having to deliver actual meaningful growth. This is something biologists would label a cancer. But this was an ideology pushed well before generative AI became viable.

This graph shows that they have, at least in part, succeeded in that mission. It just wasn’t achieved through AI’s actual performance. Instead, they used their size, the unique economic landscape of the post-COVID world, and the widespread propaganda-driven speculation of AI technology to forge their own circular economy, away from the democratic control of the free market, monetary policies, or governmental regulations. That last part is particularly true now that Trump is in power, as he is actively deregulating their industries. And all of these factors together are channelling control and wealth away from the 99% and straight into the 1%’s already bulging pockets.

That is why this graph is terrifying. It shows that the authoritarian oligarchy has not just taken control of the politics in the US but also its very economic foundations. It is an unseen authoritarian corporate coup in the world’s most powerful country. That is literally deathly terrifying for every living person on the planet.